How to find your 2019 Shopify Payments 1099-K

·If you use Shopify Payments, you may wonder where to find the 1099-K you need for your business taxes. Shopify does not make it easy to find, but with the help of Shopify’s chat support I was able to navigate to the form. I’ve outlined the steps below to find your Shopify 1099-K.

- Log into your dashboard and click on “Settings” at the bottom left of the screen.

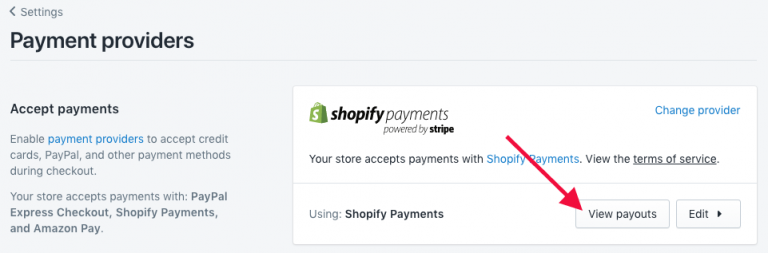

- Click on “Payment Providers.”

- Click on “View Payouts” under Shopify Payments.

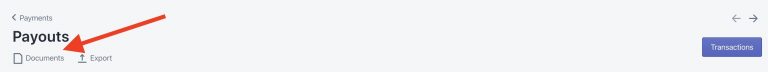

- Click on “Documents.”

- Download the PDF of your 1099-K.

Also important: You’ll also want to find an accounting of all of the fees you paid in the tax year to record as expenses. To do that, on the payouts page export a record of all of the payouts for the tax year. That will include all of the fees you paid.

There you go. Now get to work on your taxes.

Why you may not have a 1099-K

Shopify says that for 2019, “Shopify is required to submit a 1099-K form to the IRS for each merchant who processes more than $20,000 and has more than 200 transactions in a calendar year (or less if they’re in MA or VT states). If you qualify for a form, you will see this by clicking the documents link at the top left of your Shopify Payments payout page.”

If you didn’t earn enough or have enough transactions you will no receive a 1099-K form.

January 2020 Update: Originally posted in February 2018, these instructions still work in January 2020.

March 2020 Update: Added information about why you may not receive a 1099-K form from Shopify.